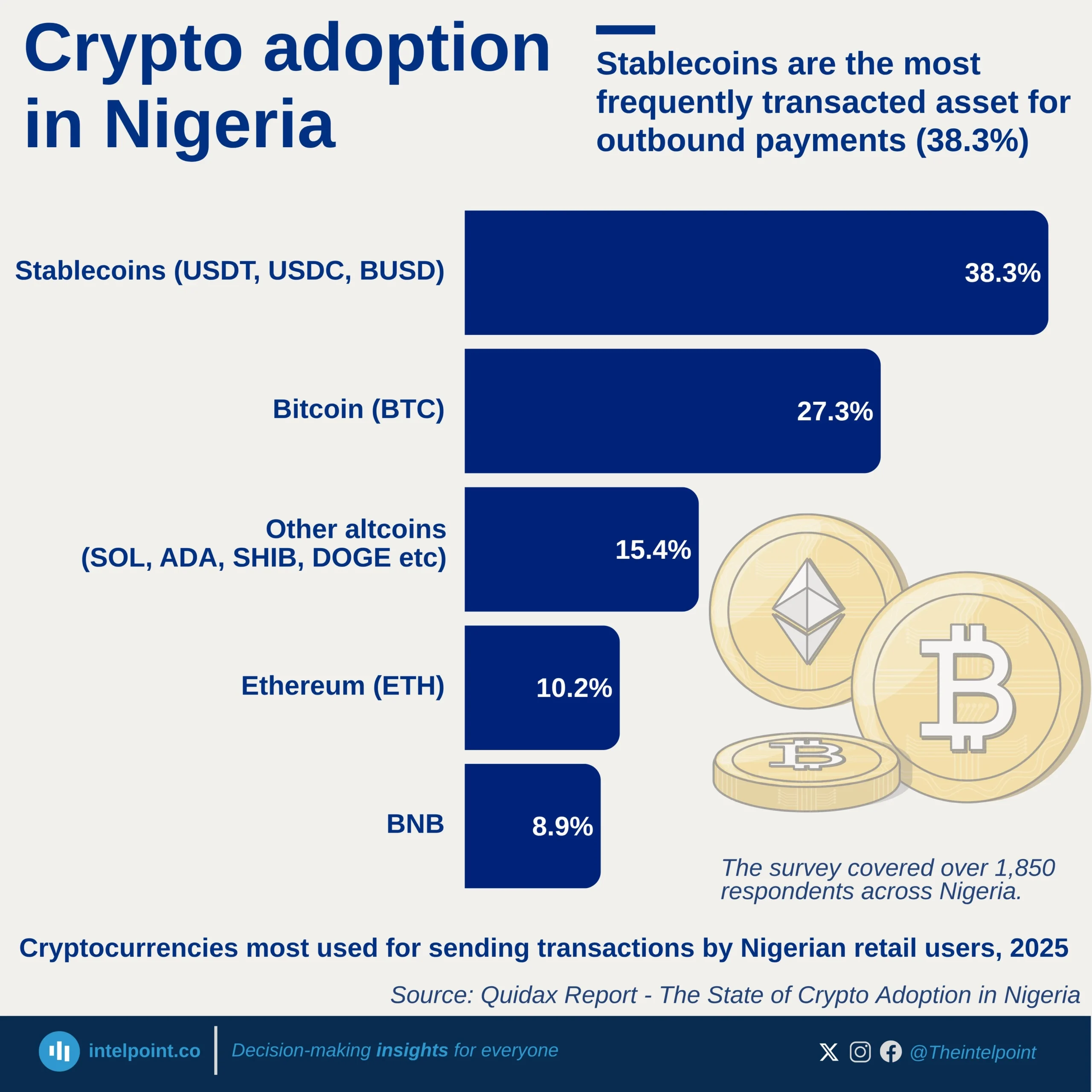

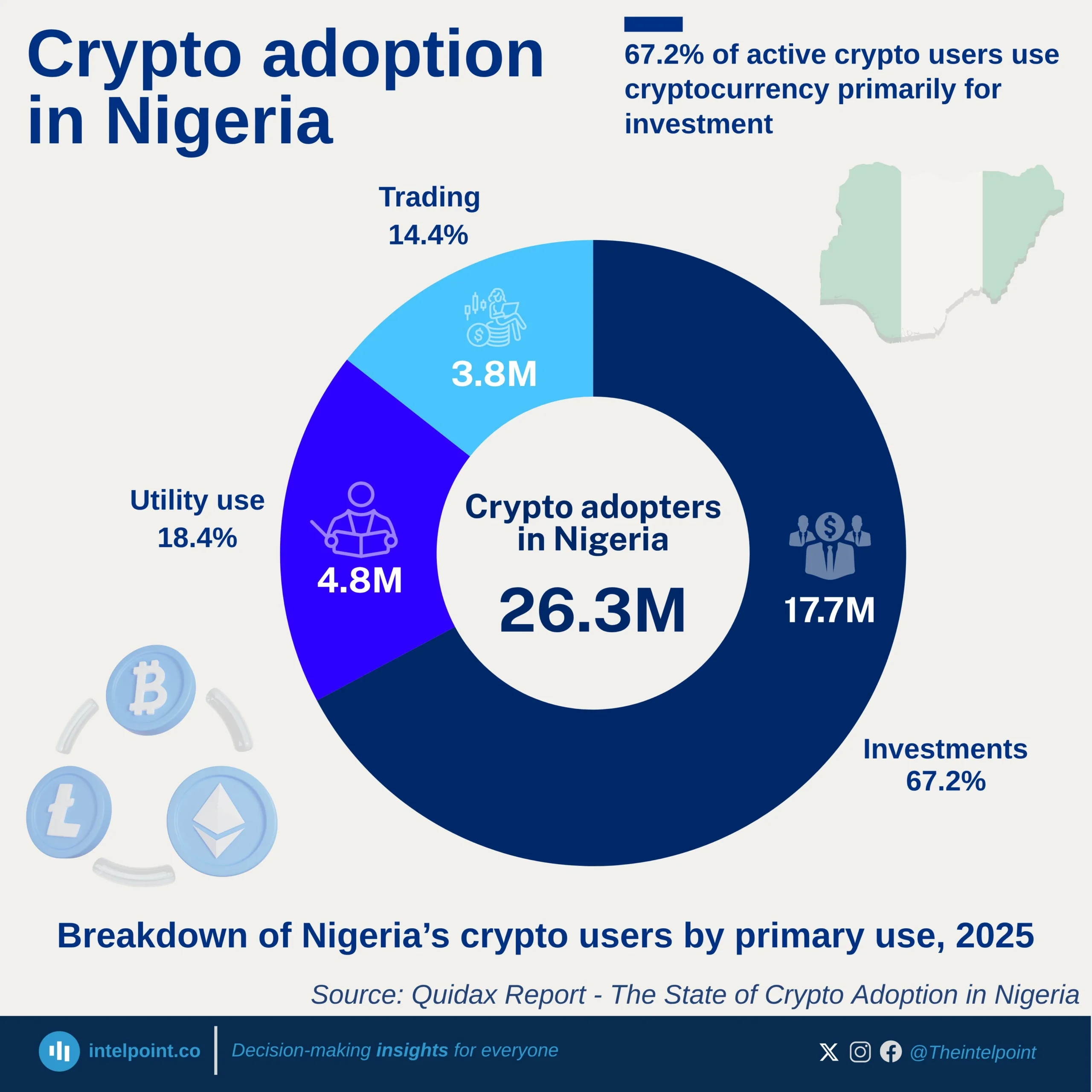

Nigerian crypto users are not passive holders, they’re active participants in a dynamic ecosystem. With 56% mostly sending crypto, activity is dominated by investments and real-world payments rather than mere speculation. Nearly a third of users deploy crypto to fund new projects or platforms, while one in four use it for daily bills and services. The pattern highlights crypto’s evolution from a trading asset to a multifunctional financial tool, connecting investment, commerce, and cross-border value transfer within Nigeria’s fast-adapting digital economy.