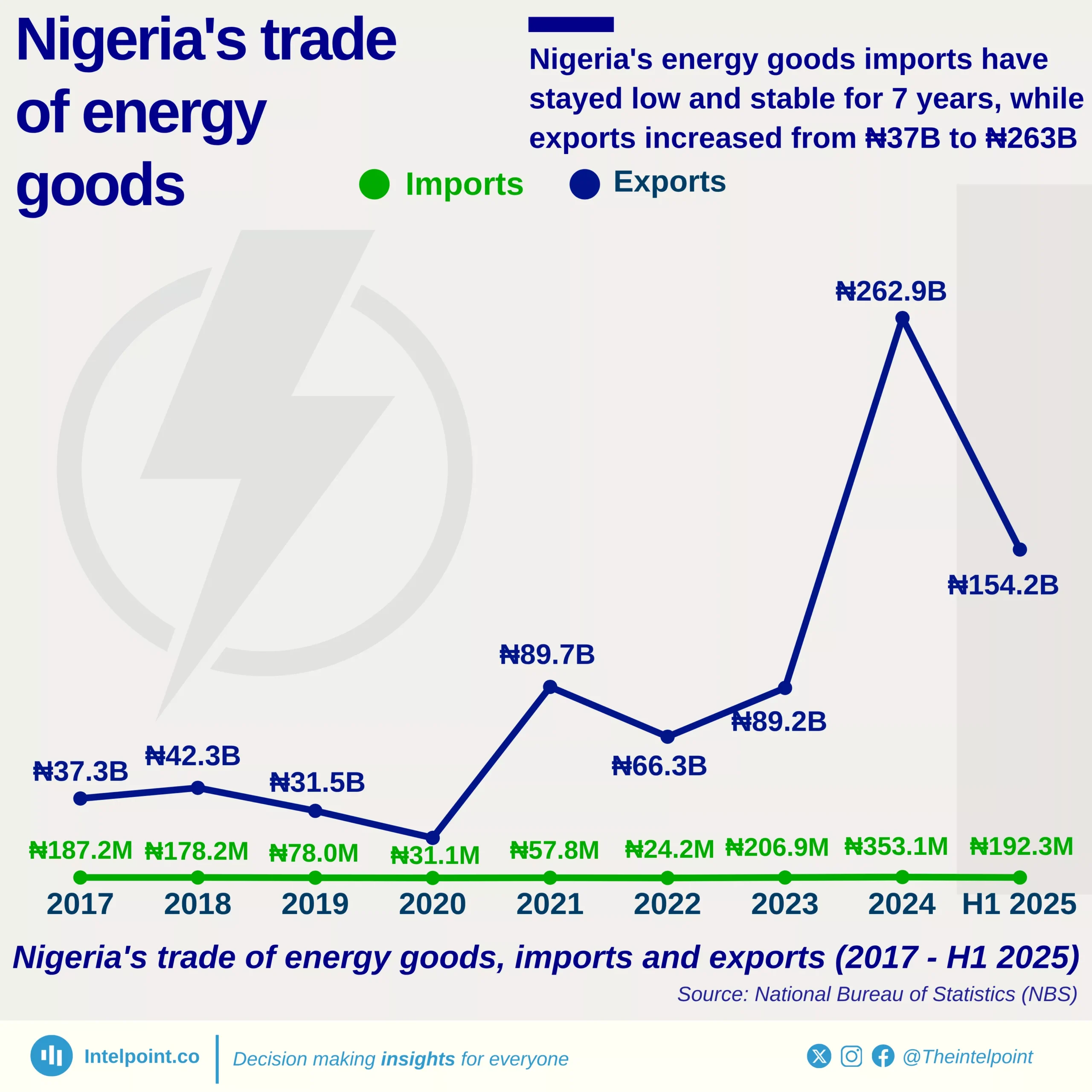

Nigeria’s exports remain heavily reliant on oil, but non-oil exports are gaining traction. In 2024, non-oil contributions ranged from 6.9% in February to 16.4% in July, with double-digit shares maintained in the second half of the year. Early 2025 saw non-oil shares reach 18.1% in January and stay above 11% through June, highlighting gradual diversification beyond oil.