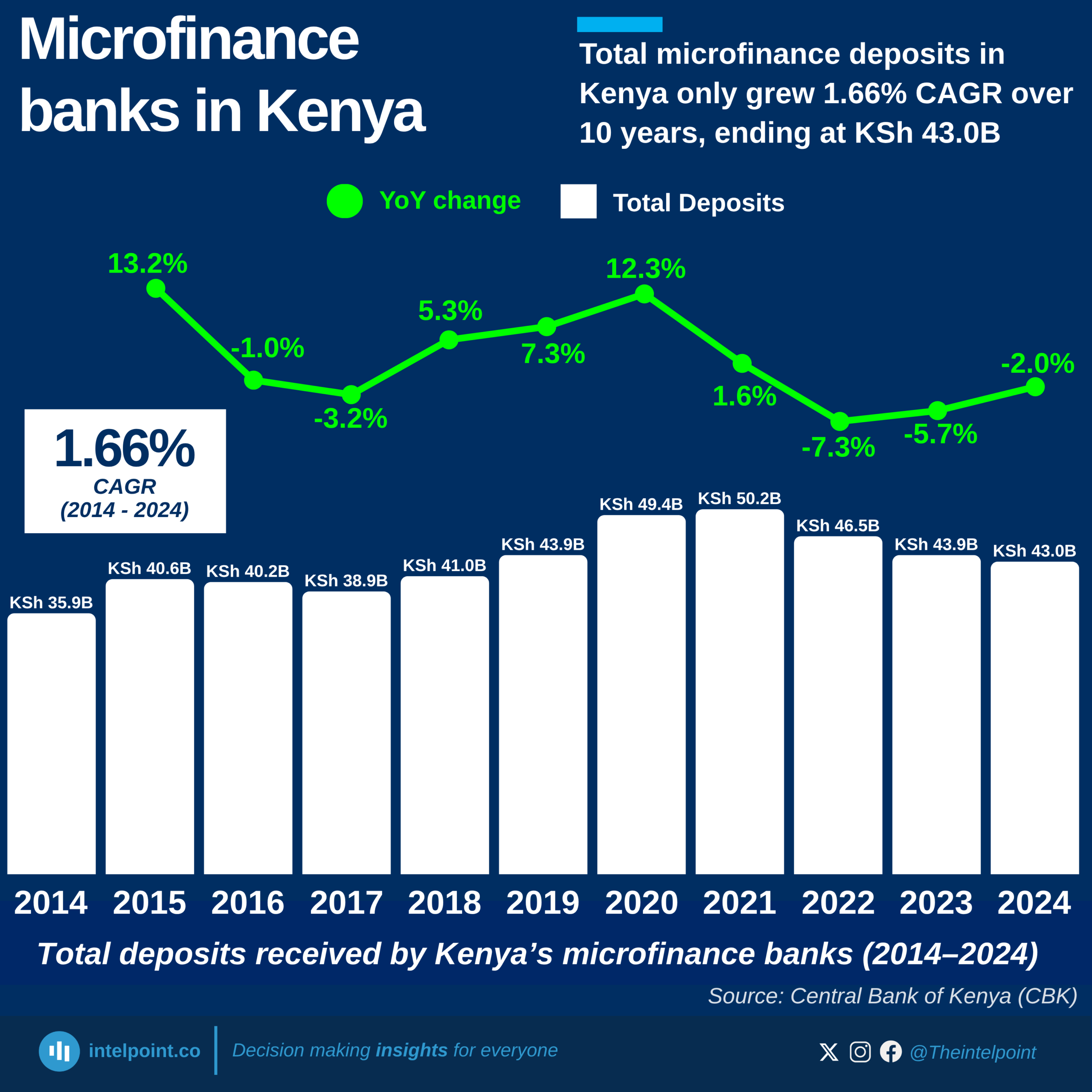

Kenya’s microfinance sector assets have shown only 1.62% growth over the past 10 years. In 2014, the sector’s assets were valued at KSh 57.0B, and by 2024, they had barely moved to KSh 57.9B.

At their peak in 2019, microfinance banks held KSh 76.4B in assets, but since then, the sector has been on a downward trend, shedding value year after year. The sharpest declines were observed in 2023 (-8.8%) and 2024 (-9.8%), erasing much of the growth achieved in earlier years.