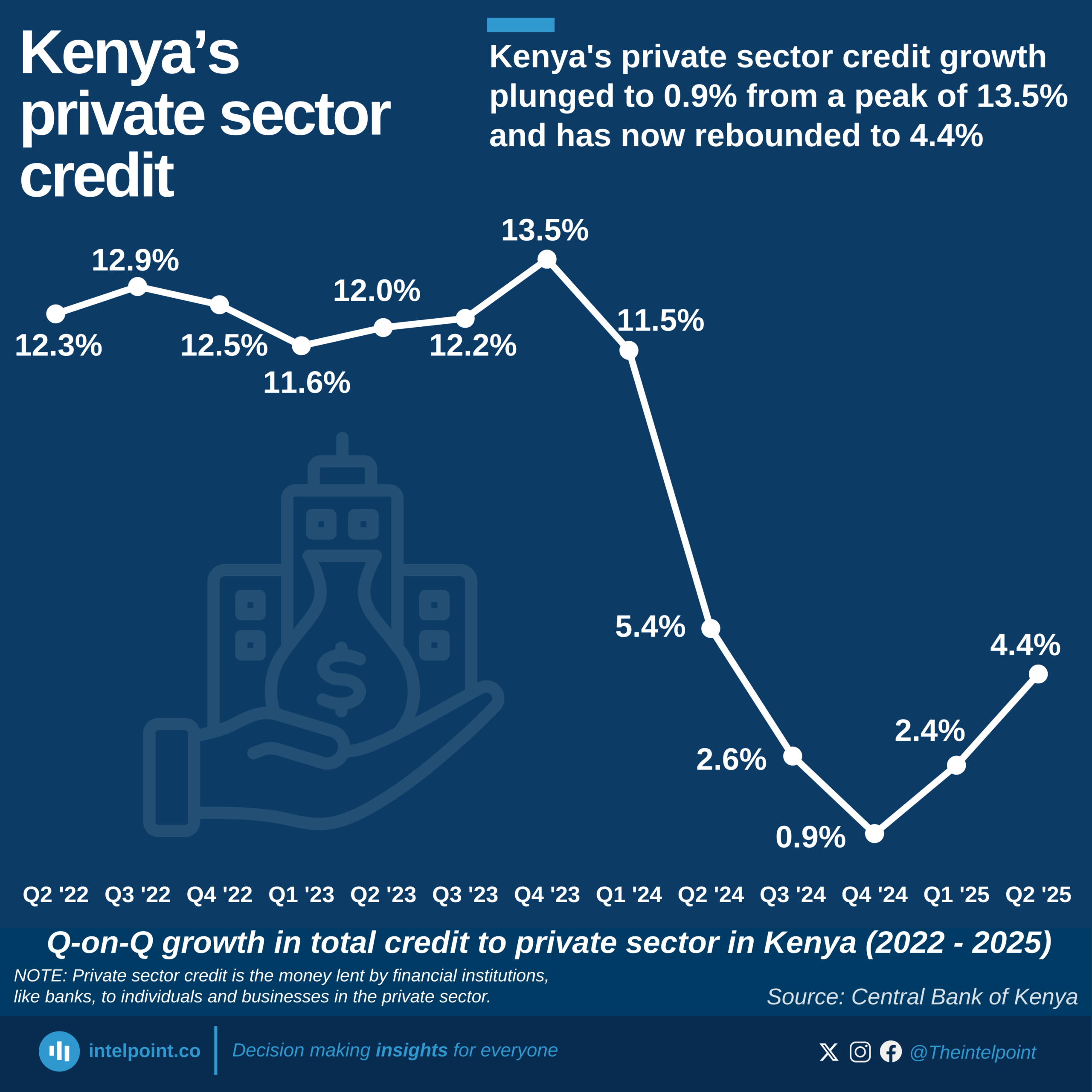

Private sector credit in Kenya as of June 2025 is heavily concentrated in a few key areas, with households, trade, and manufacturing accounting for over half of all outstanding loans. Together, these three sectors make up 54.5% of private sector credit, underscoring the central role they play in the country’s economic activity and financial system. Notably, private households alone account for the largest share at 27.8%, highlighting the growing demand for personal and non-business-related financing.

The trade sector, at 14.4%, comes in second, reflecting the importance of commerce in Kenya’s economy, particularly for SMEs and retail activities. Manufacturing follows closely with 12.3%, showing that the industry still secures significant financing, albeit behind households and trade.