The top banks in Nigeria in 2025 are Access Bank, United Bank for Africa, Zenith Bank, First Bank, and Guaranty Trust Holding Company.

Nigeria's banking sector posted a robust financial performance, with assets worth N121.8 trillion in 2023. Banking and financial institutions contributed 4.6% to Nigeria's 2023 Gross Domestic Product (GDP). Contributions in the sector increased significantly, with values rising from ₦2.722 trillion in 2022 to ₦3.5 trillion in 2023, representing a 28.86% improvement in one year alone.

The table below summarises the total assets of the top banks in Nigeria in 2025, reflecting their significant growth and financial strength in the banking sector:

| Banks | Total Assets (₦ Trillions) | Total Assets (US$ Billions) | Number of Branches | Notable Stats |

| Access Bank | 32.56 | 71.4 | 737 | Largest bank by asset size |

| United Bank for Africa (UBA) | 25.37 | 56.0 | 451 | Strong focus on SMEs |

| Zenith Bank | 24.68 | 54.0 | 500 | High profitability and digital focus |

| FBN Holdings (First Bank of Nigeria) | 16.90 | 37.9 | 750 | One of the oldest banks in Nigeria |

| Guaranty Trust Holding Company (GTCO) | 9.69 | 21.6 | 270 | Focus on innovative banking solutions |

Key takeaways

- Nigeria's top 5 banks (Access Bank, UBA, Zenith Bank, FBN Holdings, and GTCO) dominate the sector with combined assets worth over ₦146 trillion.

- The banking sector performed remarkably in 2023, accounting for 4.6% of the country's GDP through a year-over-year improvement of 28.86%.

- Access Bank is the market leader with assets worth ₦32.56 trillion and 737 branches, followed by UBA's robust presence in the continent-wide market spanning 20 countries.

- Digital transformation is boosting the business, with GTCO recording a 97.3% rise in e-business revenues and Zenith Bank recording a 118% rise in gross earnings.

- The sector is financially sound, with capital adequacy and liquidity levels of 12.3% and 41.6%, respectively, far beyond the regulatory norms.

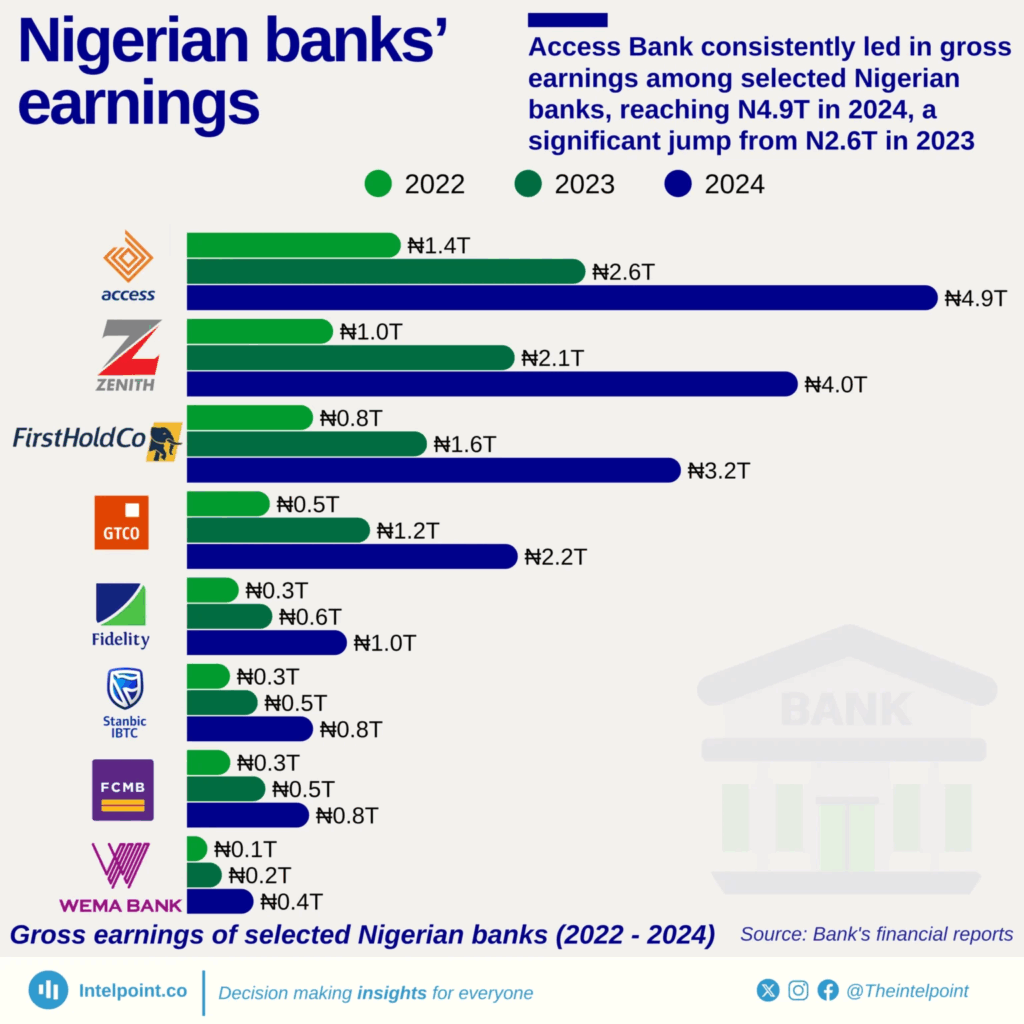

Performance harvested by IntelPoint from the various banks’ audited financial reports showed how Access Bank tightened its grip on the industry’s top spot, with gross earnings soaring from ₦2.6 trillion in 2023 to ₦4.9 trillion in 2024.

The real story, however, is the rapid growth seen across the sector between 2022 and 2024. GTCO’s earnings leapt from ₦0.5 trillion in 2022 to ₦2.2 trillion in 2024, which is more than a fourfold increase. Even smaller lenders are riding the wave: Wema Bank quadrupled earnings from ₦0.1 trillion to ₦0.4 trillion in the same period.

This sharp rise suggests Nigerian banks are not only bouncing back from earlier economic pressures but are aggressively scaling up revenues and expanding their market share.

Full review of the top banks in Nigeria

Let’s review the top banks in Nigeria based on their strengths, weaknesses, and overall impact on the Nigerian financial landscape.

1. Access Bank: “The Largest Bank in Nigeria” [Best for Comprehensive Banking Services]

Access Bank is the largest bank in Nigeria, servicing over 42 million customers through its over 740+ branches in Nigeria and Africa at large. Access Bank has assets worth around $22.419 billion (NGN 36.5 trillion). It is one of the market leaders in Africa’s banking sector.

Key Features:

- Diverse Financial Products: Offers multiple financial services, including corporate banking, investment banking, and retail banking, together with wealth management.

- Digital Solutions: Provides platforms like AccessMore App and Primus Plus for secure transactions.

- Global Footprint: Subsidiaries in multiple African countries, plus presence in the UK, UAE, Hong Kong, France, China, India, and Lebanon.

Pros:

- Extensive branch network and international presence.

- Strong commitment towards corporate social responsibility and sustainability

Cons:

- Customer service can be inconsistent owing to the business's large scale.

Ideal for: Individuals and business organisations that need complete banking services with international access.

2. United Bank for Africa (UBA): “The Pan-African Network” [Best for Broad African Coverage and Transactions]

United Bank for Africa (UBA) operates in 20 African countries, as well as the US, UK, France, and UAE, serving over 45 million customers. As of September 2024, its assets totalled $18.9 billion. The bank's network includes over 1,000 branches, 2,676 ATMs, and 354,847 POS terminals. The bank employs over 25,000 staff and supports SMEs to enhance intra-African trade. It plans to expand into Saudi Arabia in 2025.

Key Features:

- Extensive African Network: Operating presence in 20 African countries and the UK, France, and UAE.

- Comprehensive Banking: Offers diverse services like corporate, SME, and retail banking solutions.

- Digital Leadership: Serves over 30M+ online banking clients through robust online platforms.

- Broad Reach: 45M+ customers served across 1,000+ branches and touchpoints.

- Solid Financials: Made $1.06B profit before tax in 2023, recording 143% gross earnings growth.

Pros:

- Seamless transactions across Africa.

- Enhanced customer experience.

- Great for multiple marketplaces for customer-specific solutions.

Cons:

- Some customers report slow service during peak times.

Ideal for: Corporates and individuals requiring secure and efficient international banking transactions across Africa.

3. Zenith Bank: “The Tier-1 Leader” [Best for Strong Financial Performance and Reliability]

Zenith Bank is a leading Tier-1 financial institution in Nigeria, renowned for its strong financial performance and reliability, with a network of over 500 branches and service centres. In Q3 2024, the bank achieved gross earnings of N2.9 trillion, representing a 118% increase from N1.33 trillion in Q3 2023. Profit after tax for the same period reached N827.3 billion, a 90.54% increase year over year. The bank's total assets rose by 67.30% to N30.38 trillion in 9M 2024. Zenith Bank maintains a cost-to-income ratio of 39.50% as of 9M 2024.

Key Features:

- Wide Range of Services: Zenith Bank offers diverse financial services, including corporate, commercial, and retail banking, catering to various customer needs.

- Customer-Centric Services: Individualised financial solutions for various demands.

- Digital Banking Focus: Zenith Bank provides convenient and efficient online banking services.

Pros:

- Enhances customer security and trust.

- Resonates with tech-savvy buyers.

- Focus on digital banking enhances customer convenience and accessibility.

Cons:

- Restricts international business opportunities.

Ideal for: Individuals and corporate clients searching for a strong, secure banking partner with experience.

4. Guaranty Trust Holding Company (GTCO): “The Digital Transformation Pioneer” [Best for Mobile-First Banking Solutions]

Guaranty Trust Holding Company (GTCO) has taken the lead in Nigeria's banking sector through its innovative online banking services and strong financial performance. With its nine-month profit before tax ending September 2024 being ₦1 trillion, GTCO is reputed for its profitability and investment in online progress. Its total assets were worth ₦14.5 trillion by the end of H1 2024, representing a 49.7% increase from the year-end 2023.

Key Features:

- Customer-Focused Approach: Focuses on individualised support and servicing.

- User-Friendly Mobile Application: Facilitates transactions and expands access.

- Diversified Revenue Streams: Fees and commission revenue increased by 97.3% to ₦180.2 billion in 9M 2024, driven by a 53.7% increase in e-business income.

Pros:

- Its technological advancements place it ahead of its time.

- It focuses on exceptional customer support.

Cons:

- Operating expenses rose by 61.1% to ₦297.4 billion due to increased energy costs and inflationary pressures.

Ideal for: Individuals and corporate clients seeking an innovative and convenient online banking experience.

5. FBN Holdings (First Bank of Nigeria): “The Enduring Legacy” [Best for Heritage Banking with Extensive Services]

FBN Holdings, led by its flagship bank, the First Bank of Nigeria, is one of the country's oldest and most revered financial institutions, its history dating back to 1894. As a diversely constituted financial services holding company, FirstBank has over 12 million customer accounts via its around 750 branches.

Key Features:

- Extensive Reach: Operates via over 750 business outlets within Nigeria, ensuring broad customer access.

- Diverse Offerings: Include personal loans, business loans, and investment opportunities.

Pros:

- Strong customer trust due to its longstanding presence.

- Catering to a wide variety of financial needs.

- It has a global presence as it expands through FirstBank (UK) Limited in London and Paris, FirstBank in the Democratic Republic of Congo, Ghana, Guinea, Sierra Leone and The Gambia, FBN Bank in Senegal, as well as a Representative Office in Beijing.

Cons:

- High branch traffic will make the peak-time service slower.

Ideal for: Customers preferring traditional banking values and the full range of financial services from a solid, established bank.

Conclusion

Nigeria's banking sector demonstrated improvement, reporting total assets worth ₦107.3 trillion by November 2023, up by 50% year over year. In total, the five largest banks, Access Bank, Zenith Bank, GTB, UBA, and First Bank, hold assets worth over ₦146 trillion, underlining their market dominance. With a capital adequacy level of 12.3% and a liquidity level of 41.6%, the sector portrays high financial strength and stability.