Nigeria's pension fund experienced significant growth between 2000 and 2024, becoming well-regulated. As of Q2 2024, pension assets reached a value of ₦20.48 trillion, representing a 4.17% increase from Q1 2024, when assets stood at ₦19.66 trillion.

RSA registrations increased in quantity, with 100,063 in Q2 2024, an improvement over 89,061 in Q1 2024. In 2024, the ROI averaged for fund categories: RSA Fund I at 17.77%, RSA Fund II at 17.05%, RSA Fund III at 15.31%, and Retiree Fund IV at 14.01%.

Key takeaways

- 2000-2005: The Pension Reform Act 2004 replaced the Defined Benefit Scheme (DBS). Employers and workers both contributed 7.5% of basic salaries, with 2.5% for workers and 5% for employers.

- 2006-2010: According to the 2007 National Pension Commission annual report, Nigeria’s pension fund assets reached an all-time high of ₦815.18 billion, reflecting steady growth under the contributory scheme.

- 2011-2015: According to the 2015 annual report by Nigeria's National Pension Commission, Nigeria's pension assets under management reached approximately ₦5 trillion in December 2015.

- 2016-2020: Pension assets worth ₦6.16 trillion on December 31, 2016, increased to ₦9.58 trillion in Q3 2019 and reached a value of ₦12.3 trillion in December 2020, hitting an annual compound growth of approximately 18.3%.

- 2021-2024: Stanbic IBTC Pension Managers managed ₦4.38 trillion in Retirement Savings Accounts (RSAs) as of 2022. Pension assets continued to expand, surpassing ₦21 trillion by October 2024, maintaining an average annual growth rate of over 11%.

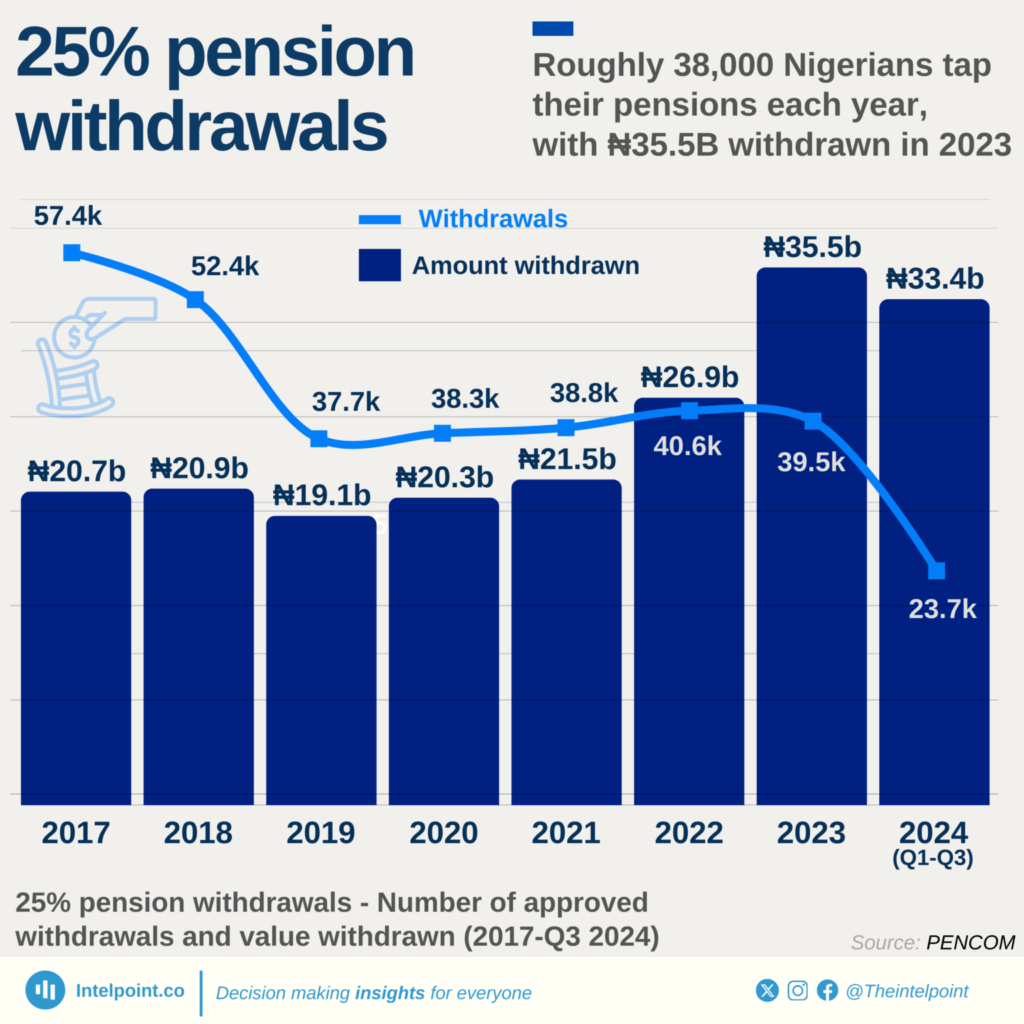

Meanwhile, data gathered by IntelPoint from the National Pension Commission showed roughly 38,000 Nigerians tap their pensions each year.

With inflation hitting 24.23% in March 2025 and the cost of food, transport, and energy still on the rise, many Nigerians are struggling to keep their household budgets afloat.

One way people are coping is by turning to their pension savings. Each year, around 38,000 workers who lose their jobs make use of the rule that allows them to withdraw up to 25% of their Retirement Savings Account (RSA).

While the number of withdrawals has stayed steady since 2019, the total amount taken out has soared. Pension payouts rose from ₦19.1 billion in 2019 to ₦35.5 billion in 2023. Between January and September 2024 alone, 23,673 withdrawals amounted to ₦33.4 billion, almost as much as the entire 2023 figure.

Best performing pension funds in Nigeria by numbers

The performance of pension funds is usually determined by the performance and ranking of the individual fund type. However, certain pension funds are picked as the overall best.

The top 5 performing pension funds in Nigeria by numbers in 2024 are:

- NPF Pension

- Access ARM Pensions

- Veritas Glanvills Pensions

- FCMB Pensions

- Leadway Pensure PFA

The table below highlights the data for the overall best-performing pension funds in Nigeria by numbers for 2024, with their fund type:

| Pension Fund Administrator (PFA) | RSA Fund I ROI (%) | RSA Fund II ROI (%) | RSA Fund IIIROI(%) | RSA Fund IV ROI (%) | RSA Fund V ROI (%) | RSA Fund VI (A) ROI (%) | RSA Fund VI (R) ROI (%) | Notes |

| NPF Pension | 38.87 | 31.56 | 30.68 | 18.05 | - | - | - | Outstanding performance across all fund types. |

| Access ARM Pensions | 21.76 | 17.45 | 16.03 | 15.19 | 21.66 | 16.68 | 16.86 | Strong management and consistent strategies. |

| Veritas Glanvills Pensions | 20.14 | 14.10 | 14.87 | 14.33 | 16.47 | 15.79 | 13.30 | Solid returns, placing them in the top quartile. |

| FCMB Pensions | 19.78 | 16.95 | 14.95 | 13.68 | 14.04 | 16.85 | 14.42 | Consistent performance in various fund categories. |

| Leadway Pensure PFA | 18.97 | 16.08 | 13.05 | 13.52 | 0.00 | 0.00 | 0.00 | Strong performance relative to other PFAs. |

Analysis of the pension funds performance

2000-2005: Regulatory foundation

Nigeria experienced a pension crisis between 2000 and 2005, with pension arrears of ₦2.56 trillion and a meager 10% of the workforce covered by pensions. In 2004, the Pension Reform Act introduced the Contributory Pension Scheme, with an 8% contribution for workers and 10% for employers.

After the reform, high pension funds such as Stanbic IBTC Pension Managers posted an average annual return of 12.5%, ARM Pension Managers at 11.8%, and First Pension Custodian at 11.5%. As of 2023, Nigeria's pension assets reached over ₦14 trillion, and workforce coverage increased to over 30%, improving the pension environment and fund management.

2006-2010: Market consolidation

Nigeria’s pension industry developed between 2006 and 2010. Pension fund assets increased from ₦361.35 billion in 2006 to ₦2.029 trillion in 2010, with assets at approximately ₦1.09899 trillion in 2008. Pension Fund Administrators (PFAs) decreased in the process, dropping to 24 from 27.

Pension contributions monthly averaged approximately $19.5 billion (roughly $130 million). The best pension funds included Stanbic IBTC Pension Managers, with an average annual performance of roughly 10%, ARM Pension Managers, and First Guarantee Pension Fund.

2011-2015: Performance optimisation

As of 2012, the National Pension Commission (PenCom) recorded approximately 5.92 million pensioners, with pension fund assets of approximately ₦3.82 trillion.

As of 2015, around ₦5.3 trillion in pension assets existed, representing 5.07% of Nigeria's Gross Domestic Product (GDP). In 2015, Stanbic IBTC received an award for Best Pension Fund Manager in Nigeria for this period.

2016-2020: Multi-fund evolution

The Nigerian pension fund industry grew with the launch of the Multi-Fund Structure in July 2018. As of December 31, 2020, assets under management reached a high of ₦12.3 trillion, a 20.44% one-year growth.

High-term fund performers included NLPC Pensions RSA Fund II and Leadway Pensure PFA Fund I, which had an annualised return of 32% combined. All Pension Fund Administrators (PFAs) delivered a positive performance for the period, reflecting strong sector performance.

2021-2024: Market maturity

Nigeria’s pension fund assets, in November 2024, reached a Net Asset Value (NAV) of ₦3.781 trillion, an 89.5% improvement over a similar period in 2023 at ₦1.995 trillion. Fund I (Aggressive Growth Fund) in 2024 reached 38.87%, Fund II (Balance Fund) reached 31.56%, Fund III (Pre-Retirement Fund) reached 30.68%, and Fund IV (Retiree Fund) reached 18.05%. On average, all pension funds in the period reached approximately 17.22%.

Conclusion

With NPF Pension, Access ARM Pensions, and FCMB Pensions being the best-performing pension funds in Nigeria by numbers, Nigeria's Contributory Pension Scheme (CPS) assets reached ₦21.92 trillion in 2024, with 10.53 million contributing registrants. It was a significant 22.34% improvement over 2023's report of ₦18.36 trillion. Nigeria's pension scheme has been a key source of assets under management, contributing 35% of the total.

FAQs

What is the current size of Nigeria's pension fund industry?

Nigeria's pension fund industry manages assets worth a total of ₦21.92 trillion. Of these, 10.53 million registrants were under the Contributory Pension Scheme (CPS).

Which PFA has the highest returns in Nigeria?

NPF Pensions has the highest returns in Nigeria, delivering an impressive 38.87% return for 2024.

What is the pension fund growth forecast?

The sector has grown remarkably, with assets growing to ₦18.36 trillion in 2023, an annual rise of 22.43%, from ₦14.99 trillion in 2022. On a long-term basis, pension fund assets could go towards ₦25 trillion in 2027.