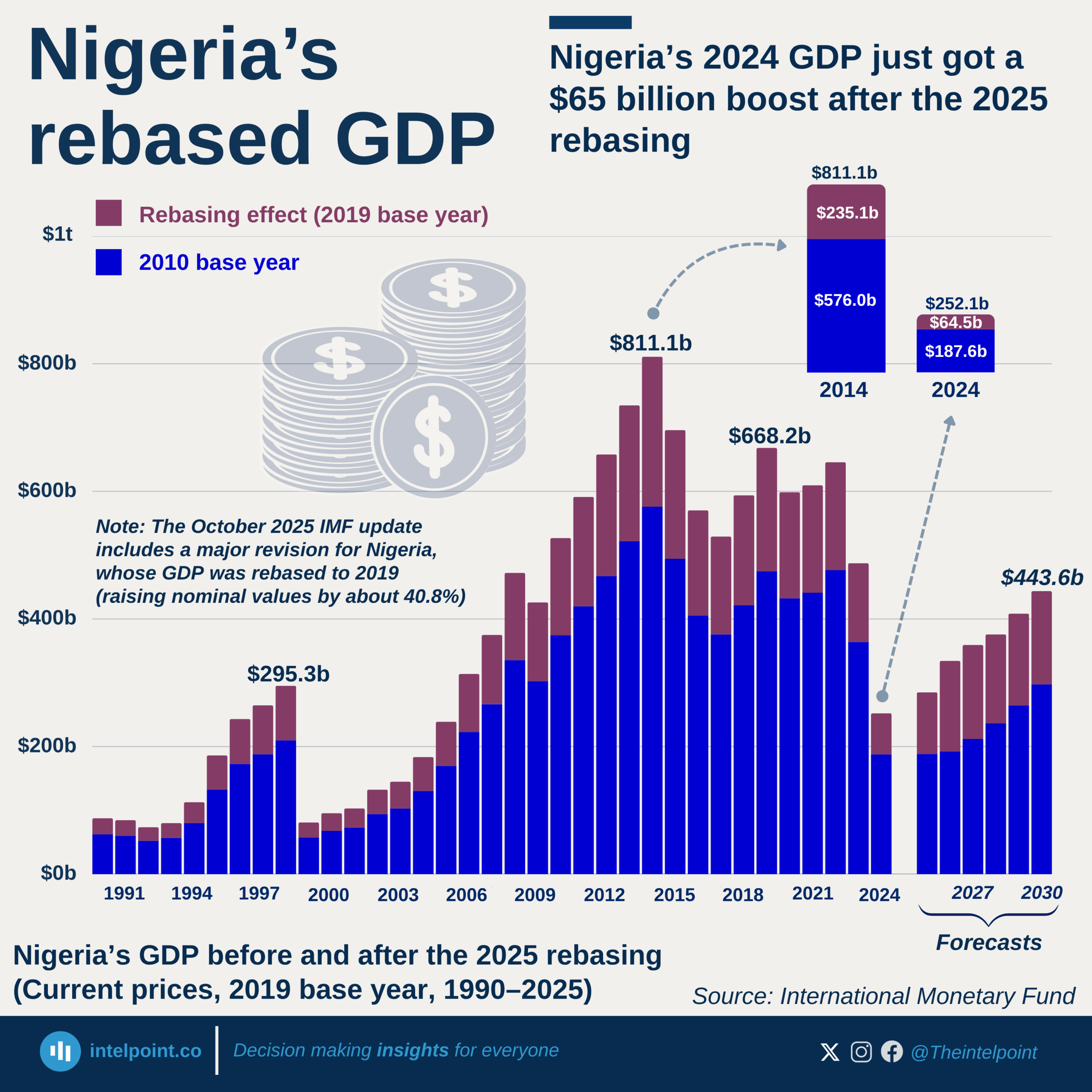

From 2002 to 2023, Nigeria’s GDP per capita consistently stayed ahead of the Sub-Saharan African average, buoyed especially during the oil boom years. The most notable lead came in 2014, when Nigeria reached $3,088.7, about 64% higher than the region’s $1,886.5. However, after the 2014 global oil crash, Nigeria’s GDP per capita began a steady descent, gradually closing the gap. By 2023, both figures had nearly converged. In 2024, Nigeria’s figure collapsed to $806.9, its lowest in two decades and now $710 below Sub-Saharan Africa’s average of $1,516.4, marking a dramatic reversal in economic positioning.