Côte d’Ivoire has substantially grown in natural rubber production, with an annual growth of over 30% and a record 1.7 million metric tons in 2023. It has made Africa the biggest and the globe's fourth-largest producer. The country accounted for approximately 7% of global natural rubber production in 2021. In 2024, Côte d’Ivoire solidified its position even more, becoming the world's third-largest producer, contributing approximately 12% of global output.

Here’s a detailed table summarizing the trends of natural rubber production in Africa from 1994-2024:

| Period | Key Events/Trends | Impact on Production |

| 1990-2000 | Initial establishment of rubber plantations in West and Central Africa. | Africa's contribution to global natural rubber production was minimal during this period. |

| 2000-2010 | Increased investments in rubber cultivation, particularly in countries like Côte d'Ivoire. | The remarkable production growth placed Côte d'Ivoire in prominence among producers. |

| 2011-2020 | The expansion of rubber plantations continued unabated. | Africa accounted for about 9.5% of the world's natural rubber production 2020. |

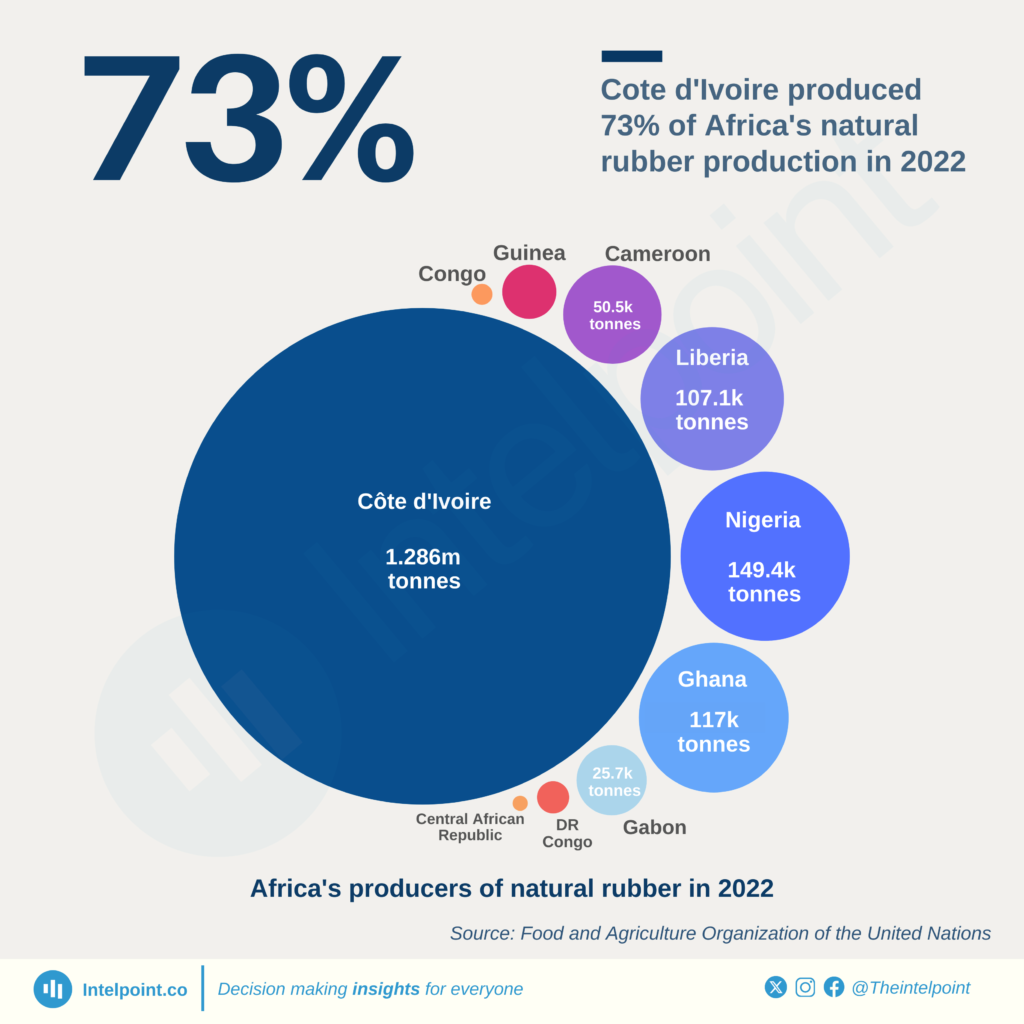

| 2021-2024 | Côte d'Ivoire took over Vietnam as the third-largest producer in the world in 2022. | Côte d'Ivoire accounted for much of the African output, with 1.55 million tonnes of natural rubber produced in 2022. |

Key takeaways

- 1990-2000: Africa’s natural rubber output index rose from 36.87 in 1994 to 60.61 in 2000, a 64% increase.

- 2000-2010: Production rose 9% from 2005-2010, with growth led by more significant investments.

- 2011-2020: Côte d'Ivoire produced more than 600,000 metric tons annually, contributing to Africa's 9.5% global output in 2020.

- 2021-2024: Côte d'Ivoire produced 1.7 million metric tons in 2023, and Africa's total output had grown to nearly 1.8 million metric tons in 2022.

Trends of natural rubber production in Africa from 1990-2024

1990–2000: Stabilization and early growth

Africa’s natural rubber output index rose from 36.87 in 1994 to 60.61 in 2000, a 64% growth in six years. Nigeria also entered the top ten global producers in 2000. Natural rubber production in 1990 was approximately 5.8 million metric tons, which increased to 7.1 million in 2000. Africa's contribution remained negligible, with under 5% of global output.

2000–2010: Accelerated expansion

Africa’s natural rubber output index increased from 73.87 in 2005 to 80.29 in 2010, up 9%. The drivers of growth were Côte d’Ivoire, Nigeria, and Cameroon. Côte d’Ivoire’s output increased in 2010, while Nigeria's remained between 140,000 and 160,000 tons. Africa still had a low global proportion, with Asia producing 87% of natural rubber worldwide.

2011–2020: Consolidation and challenges

Between 2011 and 2020, natural rubber production in Africa rose significantly, with the output index increasing from 97.16 in 2015 to 188.39 in 2020—a twofold increase in five years. In 2020, Africa produced 9.5% of the world’s natural rubber output, with Côte d’Ivoire leading the continent with over 600,000 metric tons of production yearly.

Nigeria and Cameroon contributed significantly, with 149,691 tons of output in 2020. Fluctuating global prices and infrastructure bottlenecks were the key challenges impacting output stability. Asia accounted for 87.8% of the world's natural rubber output in 2020, with Africa's share at 9.5%.

2021–2024: Resilience amidst global disruptions

Africa’s natural rubber production remained firm against global shocks. Africa produced 1.5 million metric tons. The top country, Côte d’Ivoire, produced 1.55 million metric tons, accounting for 73% of Africa's output. Nigeria produced 149,396 tons. Investment efforts kept output levels steady against adversities such as price fluctuations and global warming. Africa's natural rubber industry was valued at $2.8 billion in 2024.

Conclusion

Over the past thirty years, Africa's natural rubber production has grown significantly, with Côte d'Ivoire being a major producer. In 2023, 1.7 million metric tons of natural rubber were produced in Côte d'Ivoire, accounting for 9.5% of Africa's global output. This growth has been registered against the 8.6% annual supply growth from 2000, sustained by policies and investments.

FAQs

Why did demand for rubber increase in the nineteenth century?

The Industrial Revolution increased demand for the versatile uses of rubber in such products as tires, raincoats, and industrial machinery parts. In 1839, the discovery of vulcanization made rubber even more durable and elastic, extending its application areas.

What is the market trend for natural rubber?

The natural rubber market has experienced a roller coaster ride of high and low production, followed by increased production and falling prices. Recent trends indicate growing demand, especially from the automotive industry, significantly influencing global consumption patterns.

What are the trends in rubber manufacturing?

Today's trends focus on sustainability and efficiency. The industry is accepting alternative sources of energy and greener methods of reducing its carbon footprint. It is also working to enhance supply chain visibility and research alternative materials.

Which country produces the most natural rubber?

Thailand, Indonesia, and Vietnam were the top three global producers of natural rubber, collectively accounting for the highest share of global production.