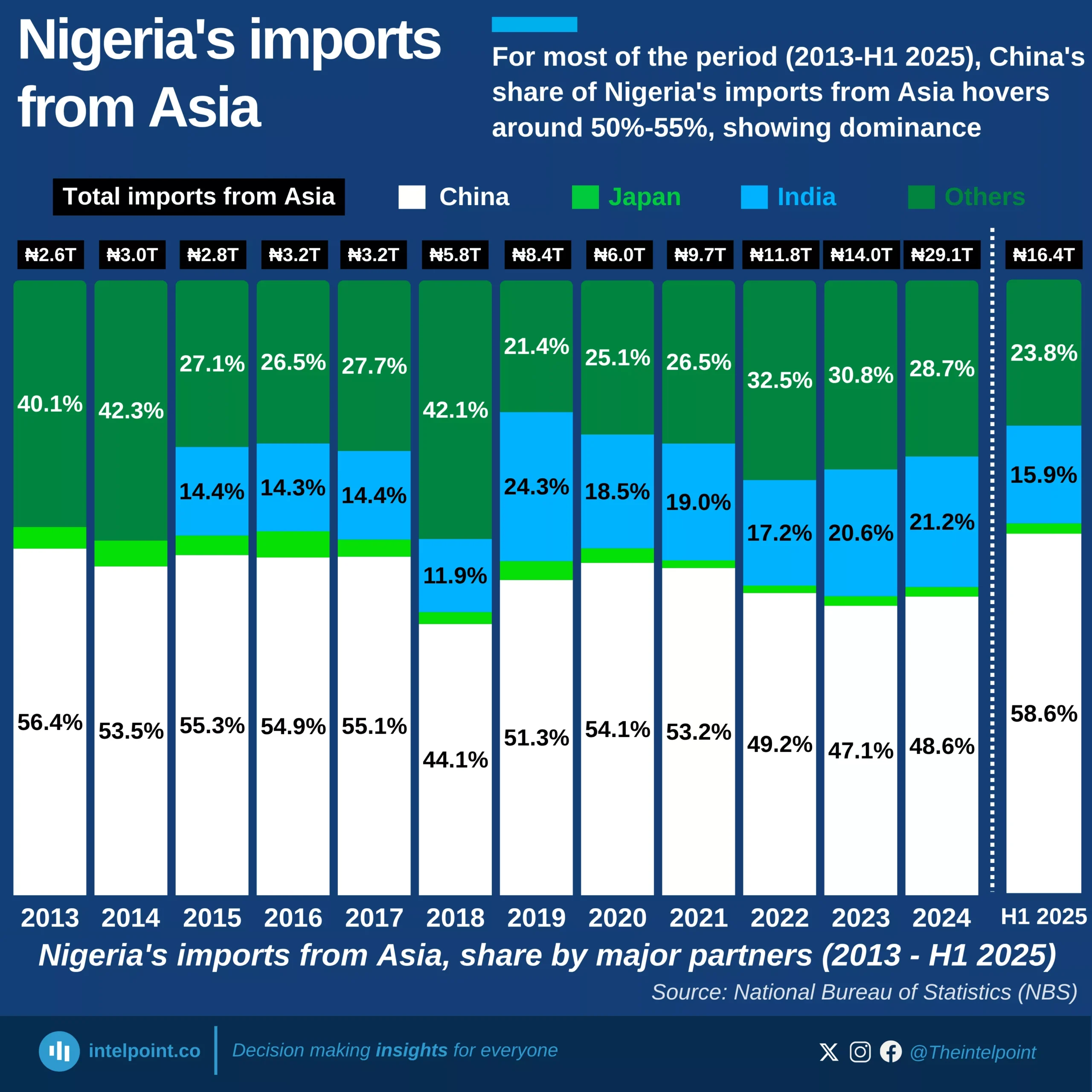

In Q2 2025, Nigeria’s foreign trade reached ₦38.04 trillion, split between ₦15.29 trillion in imports and ₦22.75 trillion in exports. China remained Nigeria’s dominant import partner, accounting for ₦4.96 trillion or 32.45% of total imports, followed by the United States at ₦2.16 trillion (14.12%).

On the export side, Spain emerged as the leading destination, absorbing ₦2.47 trillion worth of goods (10.85%), while India, France, the Netherlands, and Canada also featured prominently. This trade balance highlights Nigeria’s reliance on China and the U.S. for imports, while its export markets are more diversified across Europe, Asia, and North America.